Simple payback period formula

100 20 5 years Discounted. For example if a company invests 300000 in a new production line and the production line then produces.

B Simple Payback Vs Roi Youtube

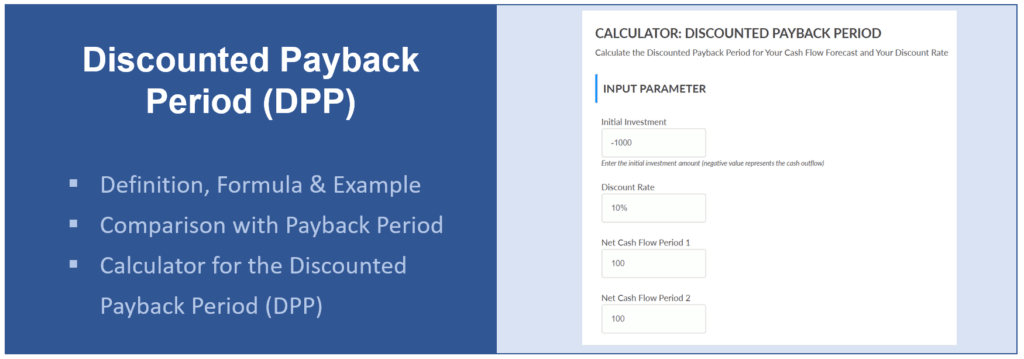

For example a 1000 investment made at the.

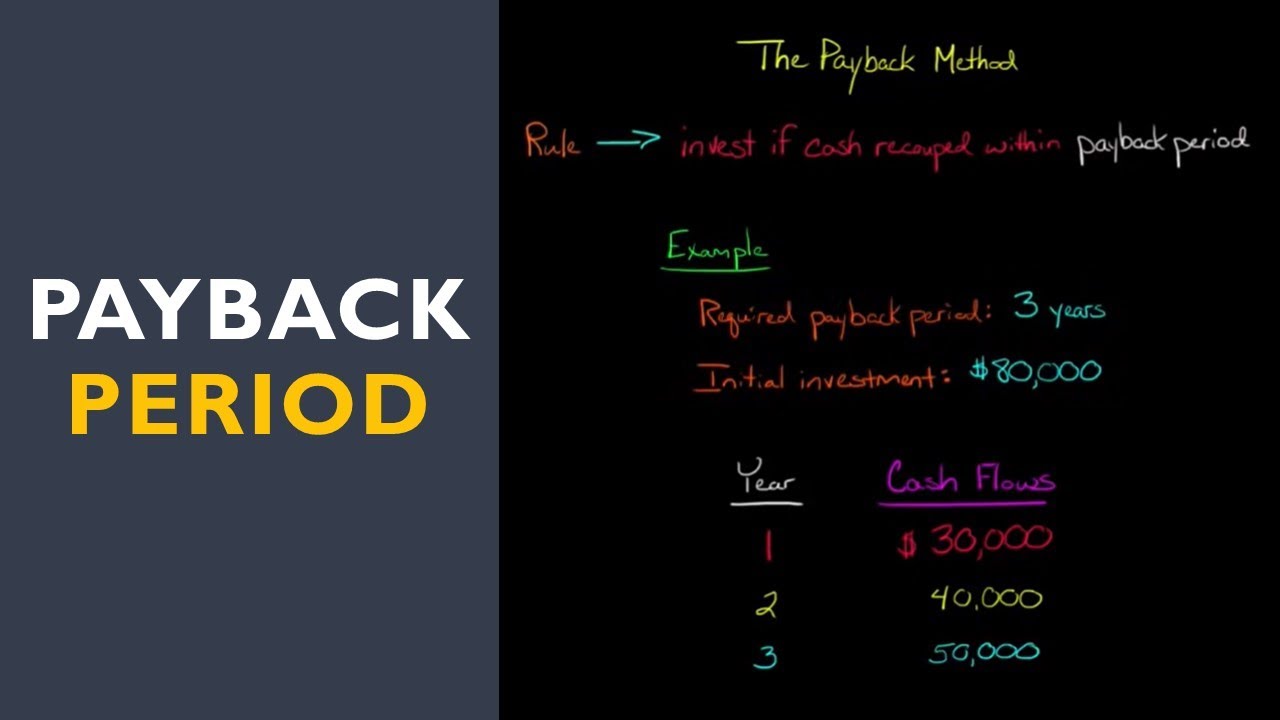

. Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before recovery Discounted cash flow in year after recovery 2. The payback period is the total investment required to purchase the asset or fund the project divided by the net annual cash flow which is. You can figure out the payback period by using the following formula.

The payback formula is simple. 400000 72000 55 years This means you could recoup your. An example would be an initial outflow of 5000 with 1000 cash inflows per month.

What is the simple payback period formula. The payback period is expressed in years and fractions of years. Payback Period Initial investment Cash flow per year As an example to calculate the payback period of a 100 investment with an annual payback of 20.

Suppose you invest 100 in a business and you earn a free cash flow or earnings or income from it as. Please find below the simple payback period formula -. The payback period formula has some unique features which make it a preferred tool for valuation.

Payback Period Initial Investment Annual Payback For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per. Features of the Payback Period Formula. The result of the payback period formula will match how often the cash flows are received.

Retrieve Last Negative Cash Flow. Input Data in Excel. Some of these are.

Find Cash Flow in Next Year. Please find below the simple payback period formula - Suppose you invest 100 in a business and you. Calculate Net Cash Flow.

Management uses the payback period calculation to decide what investments or projects to pursue. To calculate your payback period youll divide the cost of the asset 400000 by the yearly savings. Payback Period Cost of Investment Average Annual Cash Flow P aybackP eriod C ostof I.

Formula The simple payback period formula is calculated by dividing the cost of the. Payback period in capital budgeting refers to the time required to recoup the funds expended in an investment or to reach the break-even point.

How To Calculate The Payback Period With Excel

Discounted Payback Period Example 1 Youtube

What Is Payback Period Formula Calculation Example

Payback Period Method Commercestudyguide

Payback Period Formula And Calculator Excel Template

Payback Period Formula And Calculator Excel Template

Undiscounted Payback Period Discounted Payback Period

Calculate The Payback Period With This Formula

How To Calculate The Payback Period With Excel

Discounted Payback Period Definition Formula Example Calculator Project Management Info

Payback Period Business Tutor2u

Payback Period Summary And Forum 12manage

Payback Period Method Double Entry Bookkeeping

How To Calculate The Payback Period With Excel

How To Calculate The Payback Period Youtube

Payback Period Formula And Calculator Excel Template

How To Calculate Payback Period Formula In 6 Min Basic Tutorial Lesson Review Youtube